What is a Director Penalty Notice?

Director Penalty Notices (DPN) is a way in which the liability of a company can be passed on to the director personally by the ATO. Back in March the ATO recommenced issuing DPNs and has indicated that they intend to ramp up the process over coming months. The DPN is appearing to be the favoured debt collection method of the ATO at this time as they continue to shy away from issuing applications to wind up indebted companies. Accordingly, we thought it was timely to have a look at DPNs for you.

There are two main types of DPNs:

- A Lockdown DPN that is issued in situations where a company has failed to:

- Lodge their BAS within three months of the due date.

- Lodge their SGC within a month and a half after the end of the quarter.

- Has not paid the relevant debts owed.

- A Traditional DPN that is issued when:

- The company has lodged its BAS and SGC statements within the above timeframes.

- But has not paid the relevant debts owed.

What Happens If I’ve Received a Director Penalty Notice?

If you have received a traditional DPN, you have 21 days from the date of the notice to either pay the debt in full or enter into a payment plan for the outstanding debt. Alternatively you can place your company into one of three insolvency appointments. These are:

It’s important to note that the ATO does not have to ensure you receive the notice, and the liability period will begin regardless once the notice is sent to your ASIC registered address.

If after 21 days you do not pay off your company’s debt to the ATO in full or enter a payment plan, you will become personally liable for the amount given. At which point the ATO will take action to recover their debt up to and including legal and bankruptcy proceedings.

This is especially important to note for those directors who have allowed their companies to be deregistered by an ASIC strike-off action. At this point, it is difficult to re-register the company in time and place it into liquidation to avoid personal liability.

Unfortunately, if you receive a Lockdown DPN this means you are already personally liable for some of the tax debt of the Company.

What Should I Do If I Receive a Director Penalty Notice?

If you receive a DPN, absolutely do not ignore it, the best things you can do are:

- Immediately contact your accountant or advisor and begin engaging with the ATO. This is best way to give yourself the option of a payment plan.

- Look into the Director Penalty Notice defences available to you, these can include:

- Being able to prove you took all possible and reasonable steps to ensure compliance with your ATO obligations.

- Serious illness.

- Reasonable company application of the Superannuation Guarantee (Administration) Act 1992 in the case of SGC liabilities.

- Contact us or your accountant and discuss your options regarding insolvency appointments that might be suitable for your company.

As always, early action is key in preventing any serious financial penalties. If you have not yet received a DPN or a warning from the ATO. It’s always a good time to review your company’s reporting and payment practices and ensure your compliance is up to date.

What if I’m a Former or New Director?

Director Penalty Notices can be issued to former directors if the relevant debt was incurred at the time at which they were appointed.

If you have recently been appointed as a director, you have just 30 days to establish any existing ATO liabilities before they are attached to you. If it is determined that there are significant overdue liabilities, the ATO may relieve you of personal liability provided that:

- You resign as the director of the company.

- You appoint a liquidator or administrator to the company.

- The company pays off the debt.

If any of the above do not occur, the new director becomes personally liable after 30 days.

Beware of the Payment Plans

It should be noted that the ATO may request that you enter into a payment plan for the repayment of the outstanding debt as a way of resolving the DPN. There are some concerns when entering into a payment plan that you should consider:

- A payment plan with the ATO does not cause the tax debt which was due and payable to cease to be due and payable(1) accordingly, the Company is likely to be trading whilst insolvent and potential personal liability for insolvent trading may arise;

- In some circumstances, a director can become personally liable for ATO payments made under a payment plan, where they weren’t previously liable for those underlying tax debts. For example, where a Company enters into a payment plan for the repayment of PAYG and Superannuation Guarantee Charge and is subsequently placed into liquidation, the Liquidator may recover monies paid under the payment plan as an unfair preferences. Any amount disgorged by the ATO for PAYG and SGC as an unfair preference can then be claimed by the ATO against the directors personally pursuant to Section 588FGA of the Corporations Act. Accordingly, the option of entering into a payment plan may not result in an ideal outcome for directors.

- Secured Payment Plan – The ATO may seek to enter into a Payment Plan that is secured against the assets of the Company or the Directors’ personal property. Significant consideration and advice should be obtained by directors before providing real property security to the ATO to ensure that a director isn’t risking their personal property to support a failing company.

Can I get a Combined DNP?

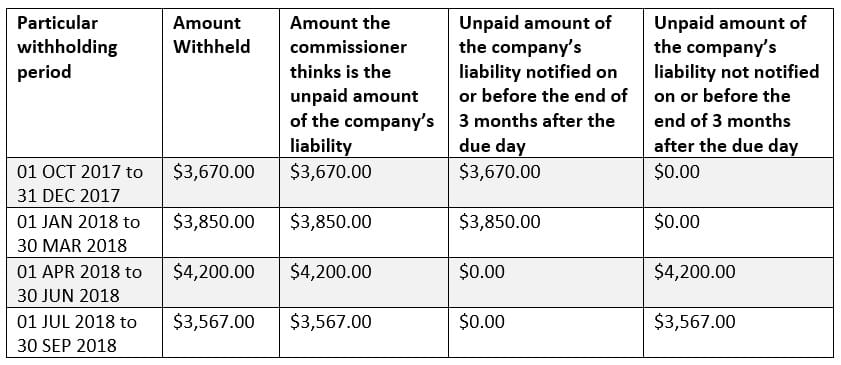

We note that the ATO may issue you with both a traditional DPN and a Lockdown DPN in one notice for different debts. It is important to examine the notice to understand your potential personal liability. An example of the particulars of a DPN, which combines both types of DPNs is as follows:

In the above example, the person has received a traditional DPN of $7,520.00 and a lockdown DPN of $7,767.00.

Key Takeaways for Directors

Some key takeaways for you to consider:

- Do not think the problem will go away if you ignore it!

- Pay your yearly ASIC fee and keep the data of your company current with their offices.

- Make sure you are lodging all required statements with the ATO within their due periods, even if you can’t pay the debt straight away.

- Seek extensions where necessary, it is far better to contact the ATO to notify them of delays or request an extension than to wait it out

- Treat your position with care and diligence and know your obligations and potential liabilities. If you are new or resigning as director than ensure you are fully aware of all current and outstanding ATO liabilities.

If you have any further questions or have recently received a DPN, please contact us immediately to discuss your options.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general to offer assistance to RRI Advisory’s clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.

1(REF Clifton (Liquidator) v Kerry J Investment Pty Ltd trading as Clenergy [2020] FCAFC 5 https://jade.io/article/708045).