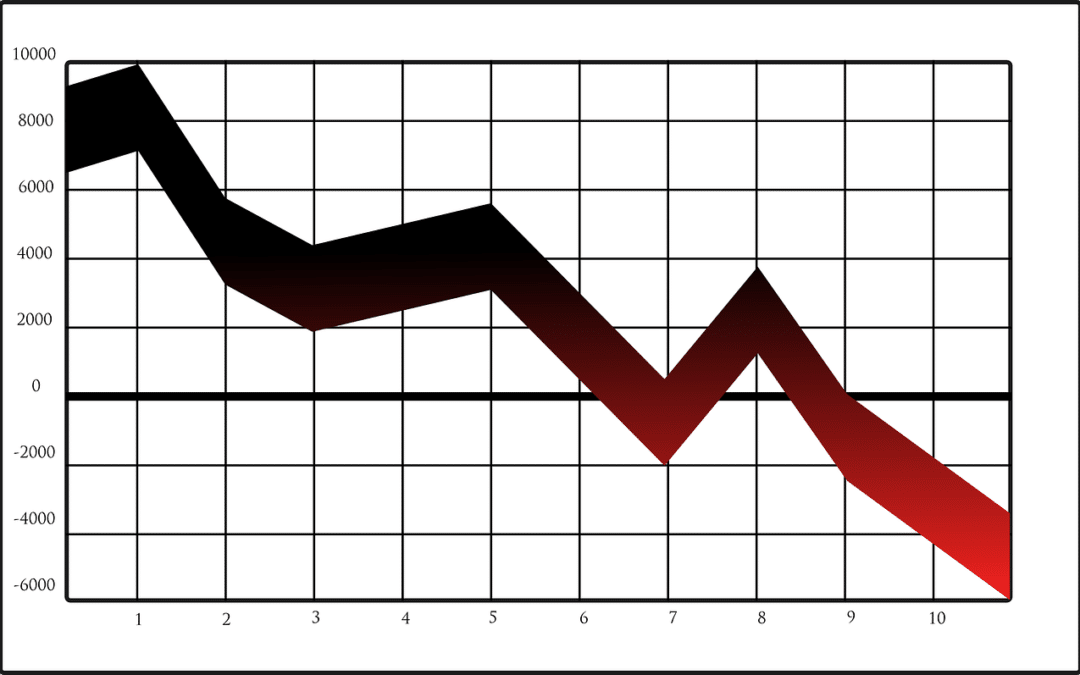

December traditionally marks our compilation of an annual list chronicling the year’s most notable corporate collapses. This task posed a challenge for several years due to the scarcity of corporate insolvencies in Australia and on the global stage. However, 2023 brought about a stark reversal, as the year witnessed a surge in large corporate collapses, leaving a trail of defunct entities in its wake.

Redcycle: A Recycling Ambition Meets Operational Hurdles

Redcycle, an industry-led soft plastics recycling business, partnered with major players like Coles and Woolworths. Despite commendable intentions, inadequate recycling infrastructure in Australia led to the stock-piling of soft plastic waste across 44 warehouses nationwide upon Redcycle’s collapse. The aftermath poses a challenge for state Environmental Protection Agencies, with uncertainty looming over whether the stockpiles will ever reach recycling facilities despite Coles and Woolworths assuming responsibility.

BWX Limited: The Downfall of an Australian Beauty Empire

BWX Limited, a prominent Australian Beauty Products business, soared with numerous brand acquisitions until lenders appointed receivers by early 2023, forcing the company into Voluntary Administration. The ongoing process of selling various company divisions to third parties remains in progress, signifying the disintegration of a once-thriving market contender.

Porter Davis Homes: From a Housing Behemoth to Liquidation

March 2023 marked the demise of Porter Davis Homes, once among Australia’s largest home builders. Liquidation revealed approximately 375 incomplete homes, and creditors owed over $500 million. While efforts were made to transfer some homes to other builders to complete, a segment relied on the last-resort insurance scheme orchestrated by the Victorian government for affected homeowners.

MILKRUN: A Rapid Collapse in the Ultra-Fast Grocery Delivery Industry

MILKRUN, unable to achieve profitability despite substantial start-up funding, succumbed as investors shifted focus to businesses with clearer commercialisation strategies. Liquidators sold the business’s intellectual property to Woolworths, enabling its revival after the collapse.

Top Place: Construction Giants’ Defective Legacy

With debts exceeding $200 million, Top Place, a construction conglomerate operational since 1992, collapsed following the loss of its building license due to unresolved defects at a Sydney development. The fallout leaves numerous property owners grappling with defects and financial losses.

Sara Lee: A Culinary Icon’s Disappointing End

An Australian culinary icon that resonates with so many people, Sara Lee attributed its collapse to escalating input costs such as rent raw materials and energy prices, supply chain disruptions, and reduced sales post-price hikes. Despite $50 million in debt, hopes persist for a business sale in early 2024.

WeWork: A Spectacular Rise and Fall

WeWork, once valued at $47 billion, saw a staggering downfall from its tech-oriented image to essentially revealing itself as an office rental business, taking on office leases in some of the most expensive real estate. Hindered by internal operating issues and COVID-19’s impact on workplaces, WeWork is navigating $18 billion in liabilities and using Chapter 11 bankruptcy proceedings to restructure its operations effectively.

Silicon Valley Bank: Tech-Oriented Bank’s Devastating Collapse

A specialized bank serving the tech industry, Silicon Valley Bank (SVB), faced a collapse due to declining bond values resulting from interest rate hikes. Despite a $1.7 billion capital raise attempt, deposit holders’ run on the bank led to receivership with the Federal Deposit Insurance Corporation stepping in.

Honorable Mentions:

Several other notable collapses deserve recognition for their impact, including Ezibuy, numerous F45 franchisees, Scotts Transport, In2food, Alice McCall, and many others. Each collapse underscores the financial tumult and challenges that characterised 2023 across various industries.

2023 stands as a testament to the unpredictable nature of corporate landscapes, with stalwart entities faltering and industries undergoing significant upheaval.

If you want to discuss what proactive steps you can take to safeguard your business, email enquiries@rriadvisory.com.au for an obligation-free insolvency consultation.

Disclaimer

This information and the contents of this publication, current as at the date of publication, is general in nature to offer assistance to RRI Advisory’s clients, prospective clients and stakeholders, and is for reference purposes only. It does not constitute legal or financial advice. If you are concerned about any topic covered, we recommend that you seek your own specific legal and financial advice before taking any action.